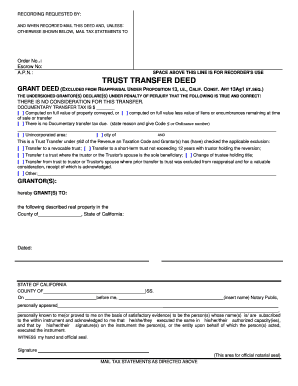

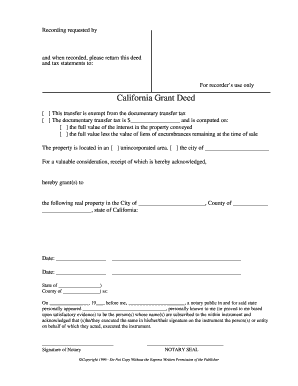

Who needs a California Trust Transfer Grant Deed form?

A person who is going to transfer a legal title in real property in the State of California to a trustee should fill out the Grant Deed form.

What is California Trust Transfer Grant Deed form for?

This Grant Deed form notarizes the transfer of the property to a trustee and tax payment for the transaction in the amount prescribed by law. In general, this document is necessary for the final registration of the property’s new owner in accordance with the Preliminary Change of Ownership Report.

Is California Trust Transfer Grant Deed form accompanied by other forms?

Filling out of the Preliminary Change of Ownership Report must precede the signing of Trust Transfer Grant Deed form.

How do I fill out California Trust Transfer Grant Deed form?

The Deed must include the name of the granter, the grantee’s name, and the legal description of the property, including the assessor’s parcel number.

Where do I send California Trust Transfer Grant Deed form?

Notarized and signed, this form should be directed to the county recorder’s office from where it will be forwarded to the county tax assessor.